Taxpayers who wish to file returns can file now for Financial Year 2020-21. On 2nd April 2021, Income Tax Department has released utilities for ITR1 and ITR4S. The Income Tax Department has released copy of all Income Tax Returns forms for AY 2021-22 FY 2020-21 on 1 April 2021 You can start your return filing procedure with the pre-filled data supplied by selecting File Returns on the relevant JSON.ITR 1 and ITR4S Forms available for Filing Income Tax Returns now for FY 2020-21

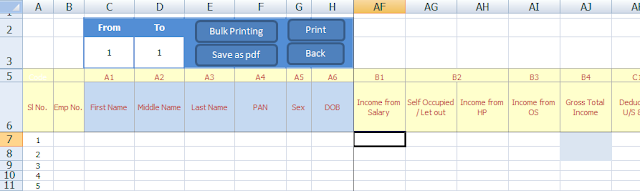

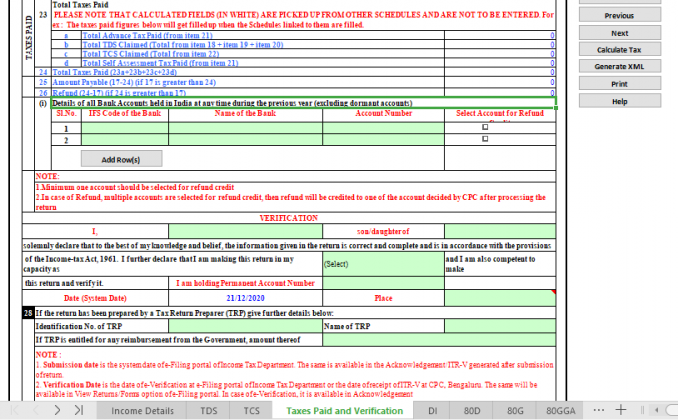

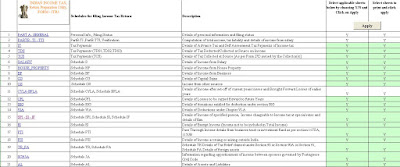

Draft Version of Returns - To update a partially filled ITR draft, go to the Draft Version of Returns tab and click Edit on the relevant draft.By choosing File Returns, you can begin filing a new return. Returns - This section contains all of your ITRs (depending on the AY).Step 3: You will be directed to the Income Tax Returns page, where the following tabs and their contents will appear: They are Returns, Draft versions, Pre-filled Data When you connect to the internet, the utility version will be updated if it was previously installed (in case of version updates). Step 2: Download the offline utility and run it. Then, under the Offline Utility option, click Download. Choose the current AY and filing mode (Offline). Here is how to file offline after logging in Income tax website Step 1: After logging into the e-Filing portal, go to e-File > Income Tax Returns > File Income Tax Return > Download Offline Utility. Downloaded offline utility for ITR-1 to ITR-4, or ITR-5 to ITR-7.Valid user ID and password for filing ITR through the offline utility.Any other Interest Income (e.g., Interest Income from unsecured loan).Interest received on enhanced compensation.Interest from Deposit (Bank / Post Office / Cooperative Society).Other sources which include (excluding winning from Lottery and Income from Race Horses):.Income from Salary / Pension, One House Property, Agricultural Income (up to Rs 5000/-).Income from Business and Profession which is computed on a presumptive basis u/s 44AD, 44ADA or 44AE.

Income not exceeding Rs 50 Lakh during the FY.

0 kommentar(er)

0 kommentar(er)